There are a number of benefits and allowances you may be entitled to which can all improve your standard of living in retirement.

Benefits and allowances

Council tax reduction

You could qualify for a discount from your Council Tax.

If you’re on a low income, or you’re claiming benefits, you could get a discount from your council tax. It’s known as ‘Council Tax Reduction’. Each local authority runs their own scheme – so it’s best to start by searching your local council’s website for information in your area. Please note a different scheme applies in Northern Ireland.

Enter your postcode in this Council Tax Reduction tool and it will give you a link that takes you directly to a page with information about the council tax discounts available in your area.

Disability allowances

Different disability schemes exist depending on your age.

There are two allowances you could qualify for if you have a disability and need help getting around or caring for yourself:

• Personal Independence Payment. This allowance is payable if you’re under State Pension Age when you claim. You can find out more here.

• Attendance Allowance. This is payable if you are over State Pension Age at the point you claim. There’s more information on Attendance Allowance here.

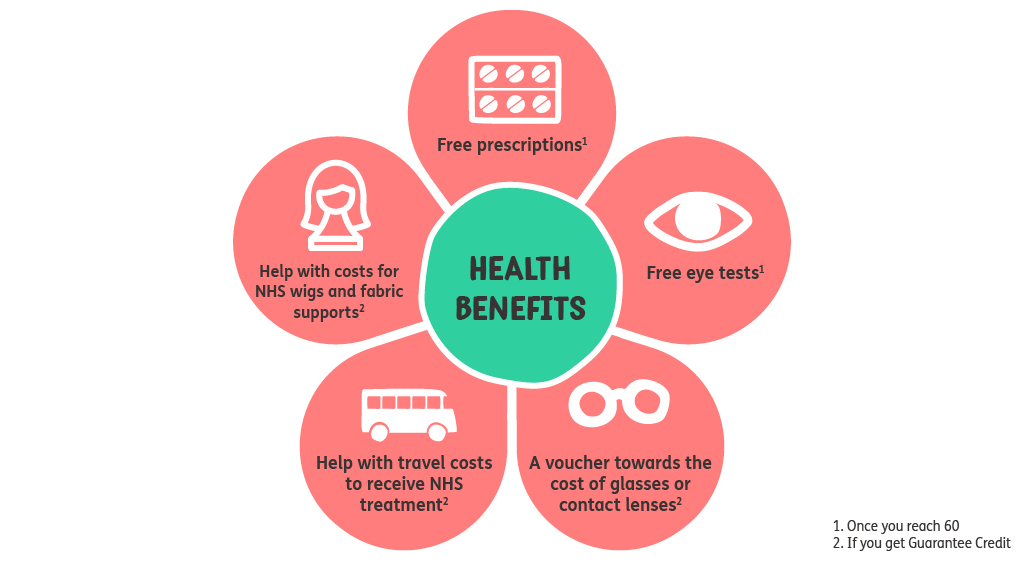

Health benefits

Most retirees will usually qualify for one or more health benefits.

You can find information on ‘Guarantee Credit’ under ‘Pension Credit’ below.

Winter Fuel Payment

A little extra towards heating your home during the winter months.

The Winter Fuel Allowance helps towards the cost of heating your home in the cold weather. To find out if you qualify, and to see how much you might be entitled to click here.

If you’re receiving your State Pension, you don’t need to take any further action. If this is the first year you qualify, and you’re not taking your State Pension, call the Winter Fuel Payments helpline on 0800 731 0160.

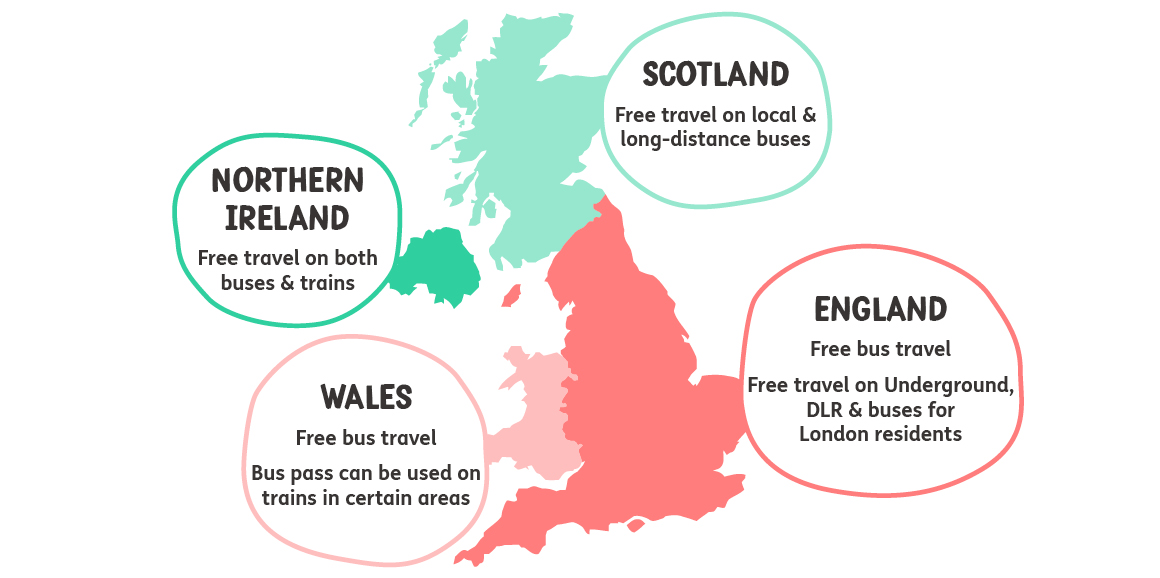

Free travel

If you’ve ever fancied a magical mystery tour.

In England you can apply for a free older person’s bus pass when you reach the State Pension Age. In Scotland, Wales and Northern Ireland the qualifying age is 60. If you live in London, you can also apply for a 60+ Oyster card. This gives free travel on almost all public transport in London. A Freedom pass is available in London from State Pension Age. This extends free bus travel to throughout the UK:

Pension credit

If you’re on a low income you could qualify for Pension Credit.

Pension Credit was introduced in 2003 to help pensioners on low incomes. There are two elements

• Guarantee credit. If you are on a low income, you may qualify for Guarantee Credit, to bring your income up to the minimum the government believes you need to live on. The age at which you can qualify for Guarantee Credit is linked to State Pension Age.

• Savings credit. You’re not eligible for Savings Credit if you turned 66 after 6 April 2016, unless you are part of a couple and one of you reached State Pension Age before this date.

You can find out if you qualify for Pension Credit here.